Type 2 Troubleshooting

I am unable to input the correct Added Years percentage into Box H on the Type 2 form.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If you are unable to enter the correct Added Years % in Box H on the 2023/24 Type 2 form downloaded from the NHS Pensions website, due to the form automatically rounding the percentage up or down (e.g. 3.2% becomes 3% and 3.6% becomes 4%).

Please be aware this has been escalated to NHS BSA who are in the process of amending the form. They have advised in the meantime that the following workaround will fix the issue:

For Box H on the 2023/24 Type 2 form, the default setting for formatting this cell is set to no decimal places, this can be changed by selecting the 'Increase Decimal' button shown in the number section on the ribbon at the top of the form.

I can't attach the Locum Shortfall Payment template with my Type 2 form.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If you have an additional document, such as the Locum Shortfall Payment template to submit alongside your Type 2 form, please follow the steps below:

Submitting your Type 2 form

- Go to GP Pensions enquiries | PCSE and choose New GP Pensions enquiry.

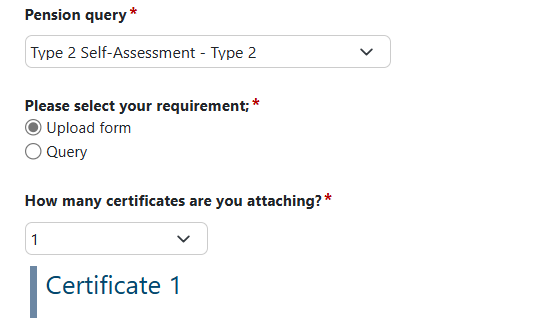

- Fill in the required information (name and contact details, query type, practice code, GMC code etc) and select Type 2 Self Assessment - Type 2 from the 'Pension query' drop down box.

- Select Upload form and then select 1 from the 'How many certificates are you attaching?' drop down box.

Do not attach any other document other than a Type 2 form here.

- Submit the contact us form.

Submitting your Locum Shortfall Payment Template

Once you have submitted your Type 2 form, you will receive an email with a CAS-reference number. You can use this reference number to attach your Locum Shortfall Payment Template to your Type 2 case.

- Go to GP Pensions enquiries | PCSE and choose Existing GP Pensions enquiry.

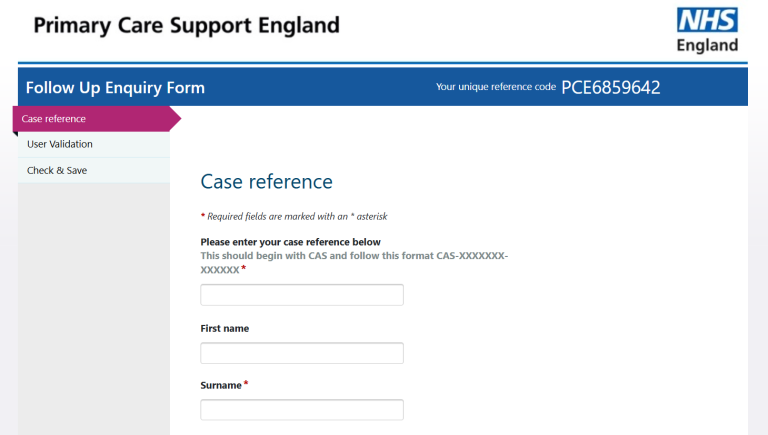

- The Follow Up Enquiry form will open.

- Click Begin

- Enter your CAS-reference number, for example CAS-1234567-1B2V3R5R and complete the required fields

This will retrieve your Type 2 case.

You can now attach any additional documents and submit. These will automatically be added to your Type 2 case.

I can't upload the Excel spreadsheet via the contact us form

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

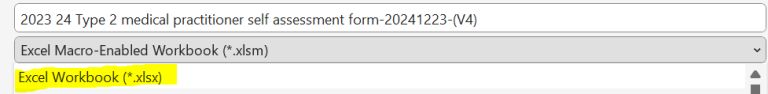

We have identified that the file type when downloaded from the NHS Pensions website, is not compatible with our online forms. This can be easily fixed.

When saving the excel spreadsheet you will need to save the excel spreadsheet as an xls file type or PDF. Please see below an example of the file type to select. Excel Marco-Enabled Workbooks are unfortunately not compatible.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

The Excel form is locked and I can't complete it.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We are aware that some NHS Pension Scheme Members are encountering an error when completing the Excel Type 2 Self Assessment form for 2023/24.

NHS Pensions is aware of the issue and has advised of a very simple workaround. A short video, demonstrating the workaround to resolve this error, can be viewed here.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

Type 2 form - no dropdown on Box 23/24

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We are aware that some NHS Pension Scheme Members are encountering an error when completing the Excel Type 2 Self Assessment form for 2023/24.

NHS Pensions is aware of the issue and has advised of a very simple workaround. A short video, demonstrating the workaround to resolve this error, can be viewed here.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.