2023/24 Type 2

Can we still submit Type 1 or Type 2 forms for missing years i.e. 2021/22?

If you are aware of any previous years that are missing certificates, please submit the appropriate form for the missing year via PCSE Online. If you have downloaded an Excel form from the NHS Pensions website, you can submit via the GP Pensions contact us form.

I am a salaried GP, do I need to complete a Type 1 form?

Where a GP is a Provider and a Salaried GP in the same year, they must complete both the Type 1 Annual Certificate and Type 2 Self Assessment form.

If the GP is Salaried only, they must complete a Type 2 Self Assessment form. 2023/24 Type 2 Self Assessment forms can be completed on PCSE Online.

I have selected the financial year, but it won't let me move on. What's wrong?

This sounds like a technical issue with your PCSE Online account. Please contact our Customer Service Centre for help.

The form won't let me submit. What's wrong?

If the Submit button is greyed out, this means there is some missing or incorrect information or this has already been submitted. Please check the status of your form in the Listings screen.

Has my form been received by PCSE?

You can check the status of the form on the NHS Pension Scheme Annual Income listing screen on PCSE Online.

Log into PCSE Online, and click GP Pensions and Payments, then Pensions and then Annual Certificate – Type 1.

You can then click on ‘NHS Pension Scheme Annual Income listing’, and this is where you’ll see all current and previous forms.

These are normally listed in date order, so you can sort on the ‘Financial Year’ column so the most recent is at the top of the list.

There are a range of statuses in the ‘Declaration Status’ column:

- Draft – you have started your form and saved it for later

- Pending – your accountant or advisor has completed your form on your behalf, and it is waiting for you to submit it

- Declarated – you have declared that your form is completed with the correct information and submitted it to PCSE for processing

- Approved – your form has been approved by PCSE. Your contributions data will be updated on your NHS Pensions record as long as you don't have any missing years

- Rejected – your form has been rejected by PCSE and needs to be corrected and resubmitted

- Resubmitted – you have made corrections to your rejected form and submitted your form again for checking/processing by the PCSE Pensions team

My Type 1 certificate has been rejected, how do I convert it back from draft?

You will need to revert your form to draft status before you can update it and resubmit it.

Log into PCSE Online, and click GP Pensions and Payments, then Pensions and then Annual Certificates– Type 1.

You can then click on ‘NHS Pension Scheme Annual Income listing’, and this is where you’ll see all current and previous forms.

These are normally listed in date order, so you can sort on the ‘Financial Year’ column so the most recent is at the top of the list.

Check you have the right certificate, in the ‘Declaration Status’ column, it will say Rejected.

To revert a form to Draft status,

- click on the red symbol (a circular arrow) in the ‘Revert to draft’ column

- A pop message will appear

- Click on Confirm

- the status will change to Draft.

To edit, then resubmit, a form that in draft status, click on the relevant blue link in the ‘Form ID’ column.

You can now edit or submit your completed form.

For GPs who submitted their end of year form via the Contact Us form, you will need to update and resubmit via the same method.

The relevant financial year is not selectable and none of that is relevant to me, it says already initiated/completed

The listings screen on PCSE Online allows members to see previously submitted Type 1 and Type 2 certificates and also any draft forms.

You can find the listing screen by logging into PCSE Online, select Payments and Pensions, select Pensions, then select Annual Certificate - Type 1 or Self Assessment - Type 2. You can then click on ‘NHS Pension Scheme Annual Income listing’, and this is where you’ll see all current and previous forms, including forms in draft status.

You can sort the ‘Financial Year’ column to easily check if forms for all years are showing as approved.

If any forms are showing as rejected you need to make the appropriate corrections and resubmit the form. If any forms are showing as declarated they are awaiting processing by PCSE.

Find out how to find and open your draft form

I saved my Type 2 form to finish later and now I can't locate it.

Log into PCSE Online, and click GP Pensions and Payments, then Pensions and then Self Assessment– Type 2

You can then click on ‘NHS Pension Scheme Annual Income listing’, and this is where you’ll see all current and previous forms.

These are normally listed in date order, so you can sort on the ‘Financial Year’ column so the most recent is at the top of the list.

Check you have the right certificate, in the ‘Declaration Status’ column, it will say Draft.

To edit a form that in draft status, click on the relevant blue link in the ‘Form ID’ column.

I can't see a form I've completed, the last one is 2021/22. Some previous years say initiated, but I know they are not completed, how can I redo those years?

If any years are showing as already initiated in the Type 1 or Type 2 screen, you need to go the Listing Screen button to see forms that are in draft status or have already been completed or processed.

If this doesn't resolve the issue then please contact PCSE. Please visit the link below, this page shows all ways you can contact us. https://pcse.england.nhs.uk/contact-us/gp-pensions-enquiries

My Type 2 form has been rejected, how do I convert it back from draft?

You will need to revert your form to draft status before you can update it and resubmit it.

Log into PCSE Online, and click GP Pensions and Payments, then Pensions and then Self Assessments– Type 2.

You can then click on ‘NHS Pension Scheme Annual Income listing’, and this is where you’ll see all current and previous forms.

These are normally listed in date order, so you can sort on the ‘Financial Year’ column so the most recent is at the top of the list.

Check you have the right certificate, in the ‘Declaration Status’ column, it will say Rejected.

To revert a form to Draft status,

- click on the red symbol (a circular arrow) in the ‘Revert to draft’ column

- A pop message will appear

- Click on Confirm

- the status will change to Draft.

To edit, then resubmit, a form that in draft status, click on the relevant blue link in the ‘Form ID’ column.

You can now edit or submit your completed form.

For GPs who submitted their end of year form via the Contact Us form, you will need to update and resubmit via the same method.

Can we save the forms to complete at a later date?

Yes, simply click 'save for later' and the form will be saved as a draft.

You can then retrieve the draft form from the Listings screen. Find out more here - the process is the same for both Type 1 and Type 2 forms.

Do we get confirmation the form has been successfully submitted?

Once you have submitted your form for processing on PCSE Online, its status will show as 'declarated' on the Type 2 Listings screen.

Why is the total income showing on my Employee Contribution Statement on PCSE Online for my salaried role different to my month 12 payslip, and which of the two do I use for my Type 2 form?

Your Employee Contribution Statement on PCSE Online shows the contributions that have been deducted from the practice based on the Pensionable Pay and Tier Rate figures they entered on the Annual Estimate they submitted at the start of the pension year. It is quite common that these figures differ from what you see on your payslips.

On your 2023/24 Type 2 form, you need to enter the employee contribution figure from your month 12 payslip in Box 2a (Conts already paid by the salaried GP). The figure from your PCSE Online Employee Contribution Statement should be entered in Box 2c.

Please note, Box 2c is not mandatory.

What should I do if there is a difference showing in Box 2c (or 2(i)c, 2(ii), 2(iii)c) for my salaried role?

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

You should show your completed Type 2 form to the Practice Administrator or Payroll Manager responsible for pension contributions at the practice.

If you have overpaid employee contributions, the practice will arrange a refund for you (normally via payroll) once your Type 2 form has been processed.

If you have underpaid contributions, the practice will arrange to collect the arrears from you (normally via payroll) once your Type 2 form has been processed.

What should I do if there is a difference showing in Box 3c (or 4c) for my solo role?

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If the Solo work was for an ICB or Out of Hours (OOH) provider, you should show your completed Type 2 form to the Payroll Manager responsible for pension contributions so that they can arrange:

- a refund for you if you have overpaid employee contributions

- to collect the arrears from you if you have underpaid employee contributions.

If you have overpaid employee contributions or Solo appraisal work, PCSE will submit a refund request to NHS England to be paid to direct.

If you have underpaid employee contributions for Solo appraisal work, PCSE will contact you with instructions on how to pay the arrears to NHS England.

What should I do if there is a difference showing in Box 5c for my locum work?

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If you have underpaid employee contributions due in relation to Locum work, you need to follow the locum shortfall process found on page 16 of the GP Pensions 2023 24 Type 2 self assessment form guide.

If you have overpaid Locum contributions, you will receive a refund from NHS England in due course.

I have been a salaried GP for a few years and I didn’t know I had to submit Type 2 forms, what do I need to do to get my pension record updated?

You need to submit Type 2 forms for all of the years that you have been a salaried GP, and you can do this on PCSE Online for the following years:

- 2015/16

- 2016/17

- 2017/18

- 2018/19

- 2019/20

- 2020/21

- 2021/22

- 2022/23

- 2023/24

Alternatively, you can downloaded the Excel form for each year from the NHS Pensions website and submit them via the contact us form on the PCSE website.

Type 2 form - no dropdown on Box 23/24

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We are aware that some NHS Pension Scheme Members are encountering an error when completing the Excel Type 2 Self Assessment form for 2023/24.

NHS Pensions is aware of the issue and has advised of a very simple workaround. A short video, demonstrating the workaround to resolve this error, can be viewed here.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

The Excel form is locked and I can't complete it.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We are aware that some NHS Pension Scheme Members are encountering an error when completing the Excel Type 2 Self Assessment form for 2023/24.

NHS Pensions is aware of the issue and has advised of a very simple workaround. A short video, demonstrating the workaround to resolve this error, can be viewed here.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

I can't upload the Excel spreadsheet via the contact us form

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We have identified that the file type when downloaded from the NHS Pensions website, is not compatible with our online forms. This can be easily fixed.

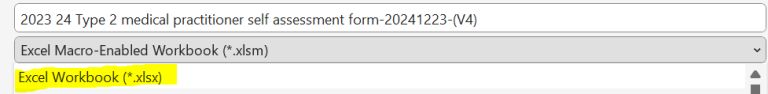

When saving the excel spreadsheet you will need to save the excel spreadsheet as an xls file type or PDF. Please see below an example of the file type to select. Excel Marco-Enabled Workbooks are unfortunately not compatible.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

I can't attach the Locum Shortfall Payment template with my Type 2 form.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If you have an additional document, such as the Locum Shortfall Payment template to submit alongside your Type 2 form, please follow the steps below:

Submitting your Type 2 form

- Go to GP Pensions enquiries | PCSE and choose New GP Pensions enquiry.

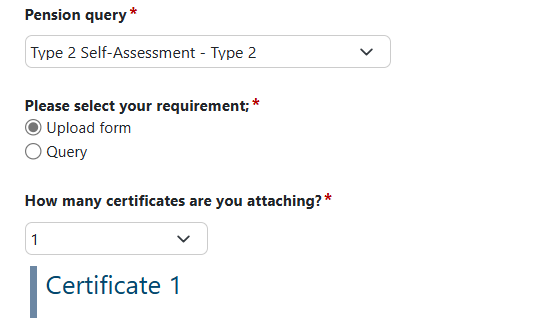

- Fill in the required information (name and contact details, query type, practice code, GMC code etc) and select Type 2 Self Assessment - Type 2 from the 'Pension query' drop down box.

- Select Upload form and then select 1 from the 'How many certificates are you attaching?' drop down box.

Do not attach any other document other than a Type 2 form here.

- Submit the contact us form.

Submitting your Locum Shortfall Payment Template

Once you have submitted your Type 2 form, you will receive an email with a CAS-reference number. You can use this reference number to attach your Locum Shortfall Payment Template to your Type 2 case.

- Go to GP Pensions enquiries | PCSE and choose Existing GP Pensions enquiry.

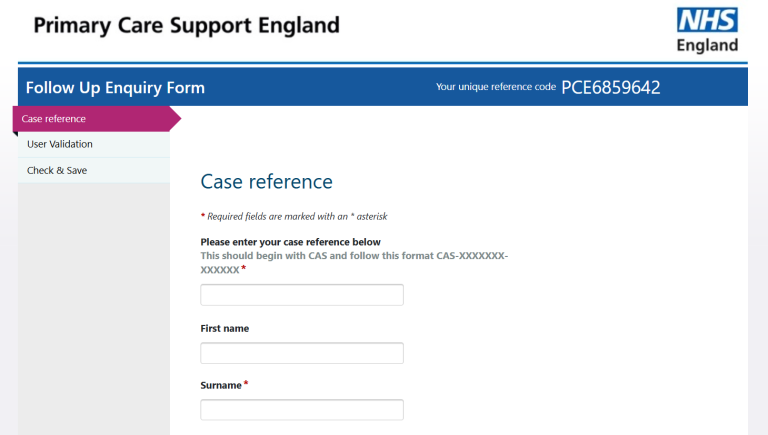

- The Follow Up Enquiry form will open.

- Click Begin

- Enter your CAS-reference number, for example CAS-1234567-1B2V3R5R and complete the required fields

This will retrieve your Type 2 case.

You can now attach any additional documents and submit. These will automatically be added to your Type 2 case.

When can I access the end of year pension forms for 2023/24?

You can complete and submit 2023/24 Type 2 forms on PCSE Online.

There is no box for "added years" contributions: what do I do with them?

Added Years contributions are a type of Additional Voluntary Contributions (AVCs).

The total amount of AVCs paid for added years, additional pension and early retirement reduction buy out (ERRBO) needs to be added in box 7.

For more information see NHS Pensions Guidance.

On the Type 2 form, it says not to include 'added years' paid, but to ensure that we pay them.?

"Added years" do need to be recorded in Box 7 of the form.

It is money purchase or free standing AVCs that must not be included.

For more information see the Type 2 guidance on the NHS Pensions website.

I am unable to input the correct Added Years percentage into Box H on the Type 2 form.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If you are unable to enter the correct Added Years % in Box H on the 2023/24 Type 2 form downloaded from the NHS Pensions website, due to the form automatically rounding the percentage up or down (e.g. 3.2% becomes 3% and 3.6% becomes 4%).

Please be aware this has been escalated to NHS BSA who are in the process of amending the form. They have advised in the meantime that the following workaround will fix the issue:

For Box H on the 2023/24 Type 2 form, the default setting for formatting this cell is set to no decimal places, this can be changed by selecting the 'Increase Decimal' button shown in the number section on the ribbon at the top of the form.

Should Added Years contributions be included on the Type 2 form?

If you had an active Added Years contract in 2023/24 you need to Select ‘Yes’ in box G in the Personal Details tab and then enter the % Added Years you pay in Box H.

In Box 8 of the Pay Details tab enter the total amount of added years pension contributions due to be paid during 1 April 2023 to 31 March 2024 based on your total income for the period at box 6 and the percentage in box H in the Personal Details tab.

Then in box 8a enter the amount of Added Years collected at source by your employers via your payslips for the period.

Box 8b will auto populate the amount of added years contributions under or overpaid during 2023/24. Any shortfall should be repaid to the relevant employer and any overpayment should be claimed back from the relevant employer.

In Box 8c show the amount that PCSE have collected directly from your employer for your added years contributions for the period. You can find this on your Employee Contribution Statement on PCSE Online but completion of the box is not mandatory.

My Type 2 form for 2022/23 has not been approved, can I still submit for 2023/24?

Yes, you should submit your 2023/24 Type 2 form by 28 February deadline regardless of whether forms from any previous years are still being processed or not.