Completing and submitting forms (T2)

What happens after I submit the Annual Certificate of Pensionable Profit - Type 1?

Certificates received before 28 February deadline

All annual pension certificates and related adjustments will be processed and adjustments will be carried out in the usual practice monthly pay run. The information should be visible on the August Total Reward Statement, assuming there are no gaps in the pension record.

Certificates received after 28 February deadline

Any certificates received after 28 February will be processed as they are received, and adjustments will be made in due course.

Any forms received past the deadline may not be reflected in the August Total Reward Statement, but will show on any future statements, assuming there are no gaps in the pension record.

Any adjustments for individual doctors/non-clinical partners will be clearly shown on the practice PCSE Online statement.

Once approved, how long does it take to go to NHS pensions?

Complete and accurate submissions received by the deadline are expected to be included in the NHS Pensions August Total Reward Statement (TRS) refresh.

What happens if you miss the deadline?

You can submit after the deadline.

However, your form may not be processed in time for the NHS Pensions August Annual Benefit Statement (ABS) (formerly known as Total Reward Statement).

If that is the case your NHS Pensions online record will be updated once NHS Pensions have completed the next TRS refresh (date yet to be confirmed).

You can however contact NHS Pensions to request a statement.

What is pensionable pay?

Find out more here .

Can we still submit Type 1 or Type 2 forms for missing years i.e. 2021/22?

If you are aware of any previous years that are missing certificates, please submit the appropriate form for the missing year via PCSE Online. If you have downloaded an Excel form from the NHS Pensions website, you can submit via the GP Pensions contact us form.

How can I find my employer's ODS code?

You can search for your employer's ODS code on the ODS Portal.

Why submit by the deadline, if forms can be updated retrospectively?

If you completed any medical practitioner work in the relevant financial year, you must, under statutory legislation, complete the relevant forms by the published deadline.

What is an earning cap?

For more information on earning caps and other related topics, visit the NHS Pensions website.

I am a salaried GP, do I need to complete a Type 1 form?

Where a GP is a Provider and a Salaried GP in the same year, they must complete both the Type 1 Annual Certificate and Type 2 Self Assessment form.

If the GP is Salaried only, they must complete a Type 2 Self Assessment form. 2023/24 Type 2 Self Assessment forms can be completed on PCSE Online.

Are there any alternative ways of submitting this form If unable to submit the form completed by the accountant on PCSE Online?

You can manually submit your form via the 'Contact us' page found at the link below if you cannot use PCSE Online.

What happens if the GP doesn't appear in the drop down list on pension joiner form but approved on Performers list?

This is most likely because we do not have the GP's Pension Scheme Membership number (SD number) attached to their record.

This could be because they have recently CCT'd.

Please let us know the SD number, so that we can add it to their PCSE Online record.

Once this is done the practice need to complete the Pensions Joiner form on PCSE Online with the GP's salary and tier rate details.

This will automatically collect the contributions due (from the date the GP started) from the practice in the next monthly statement and will update the GP's Employee Contribution Statement on PCSE Online.

After these steps have been completed the GP will be able to submit their end of year form.

What should I do if my form is too big to upload to the online form?

Please download the forms directly from the NHS BSA website, complete it electronically, save it and upload it directly to the online form. As long as you can provide a nhs.net address as a contact email address there is no need to print it off, sign it and scan back in, which often makes the file size much larger.

If you don’t have an nhs.net email address, please upload the form without the signature, and upload a separate page with the signature(s) on. The form will allow you to upload up to five documents in one submission.

I have submitted my 2020/21 several times and I don't know why there is a problem with it, nor been told of any issues. How can I resolve this?

If PCSE have been unable to process your certificate, we will have emailed an explanation to the submitter.

If you need to contact PCSE for further information please quote the case reference for your rejected form.

It does not give the option for filling out forms prior to 2016/2017, so how do we fill in previous forms?

For any years prior to 20216/17, you will need to submit a paper form. You can download these from the NHS Pensions website and submit them to PCSE via the GP Pensions enquiry form.

What if we can't submit our Type 2 form via PCSE Online?

If you are unable to use PCSE Online, you can download the relevant form from the NHS Pensions website and submit to PCSE by visiting our Contact Us page and completing a GP Pensions new enquiry.

Do I need to complete a 2022/23 form?

If you were working as a GP Partner/provider or Salaried GP during the 2022/23 financial year and are an NHS Pension scheme member, you will need to complete a 2022/23 form.

If I first started as a salaried GP in Sept 2023, when do I submit a Type 2 form?

The 2022/23 form needs to be completed by a GP is they worked between 1 April 2022 and 31 March 2023.

If your first post was September 2023, the first Type 2 form you will need to complete will be the 2023/2024 form.

This will be published towards the end of 2024 by NHS Pensions.

I am unable to select 22/23 in the drop down and previous years are listed in red, despite being submitted via "old" method previously and confirmed by PCSE.

If a previous financial year shows as red, this simply means the form has not been submitted on the PCSE Online portal. The listings screen on PCSE Online allows members to see previously submitted Type 1 and Type 2 certificates and also any draft forms. You will be able to see forms submitted via the "old method" that have been approved by PCSE on the Listing Screen.

You can find the listing screen by logging into PCSE Online, select Payments and Pensions, select Pensions, then select Annual Certificate - Type 1 or Self Assessment - Type 2. You can then click on ‘NHS Pension Scheme Annual Income listing’, and this is where you’ll see all current and previous forms, including forms in draft status.

You can sort the ‘Financial Year’ column to easily check if forms for all years are showing as approved.

Which roles do I need to include on my Type 2 form?

You must include any roles that are treated as practitioner in the NHS pension scheme:

- Salaried GP in a practice

- Solo work for Out of Hours, ICB or Appraisal team

- include Solo work if you have a contract for service (check with your employer if you are unsure)

- Locum Work if you have other Type 2 work:

Locum work is included on the Type 2 form if you have other Type 2 work. Locum-only GPs do not submit a Type 2 form.

You must not include any roles that are treated as officer in the NHS Pension Scheme:

- GP trainee

- Hospital post

- Academic post

Always check with your employer before completing your Type 2 form if you are unsure if a role is treated as officer or practitioner in the NHS Pension scheme.

What is pensionable pay and where do I find it?

Pensionable Pay is the total gross pay for a salaried post. This can be found on your month 12 payslip if you have worked the full year, or the total / cumulative gross pay on your last payslip if you left the post during the year.

For Solo work, your total gross pay can be found on your Annual Solo form.

For Locum work, pensionable pay is 90% of your locum fees and can be found on the Locum A and B forms that you will have submitted if you pensioned your locum work.

What do I enter in the “Employer Pay” box if I have been on maternity leave?

The "Employer pay" box on the Type 2 form is used to record the pay you would have received if you had not been on authorised leave, such as maternity leave, paternity leave, adoption leave or sick leave.

Your tier rate is based on your “Employer Pay” but you only pay employee contributions on your actual pensionable pay.

For example, if your full salary would have been £50,000 per year, but you only received £25,000 due to maternity leave, you would enter £50,000 as the Employer pay and £25,000 as Actual Pensionable Pay.

The tier rate for your employee contributions would be 10.0% (based on £50,000), if this was your only role.

What should I do if there is a difference showing in Box 2c (or 2(i)c, 2(ii), 2(iii)c) for my salaried role?

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

You should show your completed Type 2 form to the Practice Administrator or Payroll Manager responsible for pension contributions at the practice.

If you have overpaid employee contributions, the practice will arrange a refund for you (normally via payroll) once your Type 2 form has been processed.

If you have underpaid contributions, the practice will arrange to collect the arrears from you (normally via payroll) once your Type 2 form has been processed.

What should I do if there is a difference showing in Box 3c (or 4c) for my solo role?

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If the Solo work was for an ICB or Out of Hours (OOH) provider, you should show your completed Type 2 form to the Payroll Manager responsible for pension contributions so that they can arrange:

- a refund for you if you have overpaid employee contributions

- to collect the arrears from you if you have underpaid employee contributions.

If you have overpaid employee contributions or Solo appraisal work, PCSE will submit a refund request to NHS England to be paid to direct.

If you have underpaid employee contributions for Solo appraisal work, PCSE will contact you with instructions on how to pay the arrears to NHS England.

What should I do if there is a difference showing in Box 5c for my locum work?

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If you have underpaid employee contributions due in relation to Locum work, you need to follow the locum shortfall process found on page 16 of the GP Pensions 2023 24 Type 2 self assessment form guide.

If you have overpaid Locum contributions, you will receive a refund from NHS England in due course.

I have been a salaried GP for a few years and I didn’t know I had to submit Type 2 forms, what do I need to do to get my pension record updated?

You need to submit Type 2 forms for all of the years that you have been a salaried GP, and you can do this on PCSE Online for the following years:

- 2015/16

- 2016/17

- 2017/18

- 2018/19

- 2019/20

- 2020/21

- 2021/22

- 2022/23

- 2023/24

Alternatively, you can downloaded the Excel form for each year from the NHS Pensions website and submit them via the contact us form on the PCSE website.

Type 2 form - no dropdown on Box 23/24

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We are aware that some NHS Pension Scheme Members are encountering an error when completing the Excel Type 2 Self Assessment form for 2023/24.

NHS Pensions is aware of the issue and has advised of a very simple workaround. A short video, demonstrating the workaround to resolve this error, can be viewed here.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

The Excel form is locked and I can't complete it.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We are aware that some NHS Pension Scheme Members are encountering an error when completing the Excel Type 2 Self Assessment form for 2023/24.

NHS Pensions is aware of the issue and has advised of a very simple workaround. A short video, demonstrating the workaround to resolve this error, can be viewed here.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

I can't upload the Excel spreadsheet via the contact us form

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

We have identified that the file type when downloaded from the NHS Pensions website, is not compatible with our online forms. This can be easily fixed.

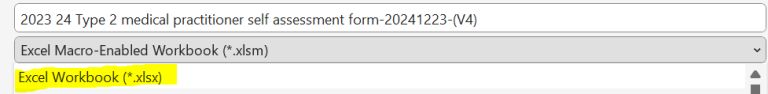

When saving the excel spreadsheet you will need to save the excel spreadsheet as an xls file type or PDF. Please see below an example of the file type to select. Excel Marco-Enabled Workbooks are unfortunately not compatible.

Please note that you will need to save the excel spreadsheet as an xls file type or PDF. This is due to the original file type not being an accepted file type that can be uploaded through our contact us form.

I can't attach the Locum Shortfall Payment template with my Type 2 form.

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

If you have an additional document, such as the Locum Shortfall Payment template to submit alongside your Type 2 form, please follow the steps below:

Submitting your Type 2 form

- Go to GP Pensions enquiries | PCSE and choose New GP Pensions enquiry.

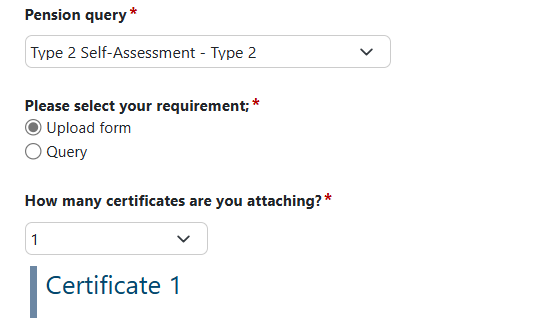

- Fill in the required information (name and contact details, query type, practice code, GMC code etc) and select Type 2 Self Assessment - Type 2 from the 'Pension query' drop down box.

- Select Upload form and then select 1 from the 'How many certificates are you attaching?' drop down box.

Do not attach any other document other than a Type 2 form here.

- Submit the contact us form.

Submitting your Locum Shortfall Payment Template

Once you have submitted your Type 2 form, you will receive an email with a CAS-reference number. You can use this reference number to attach your Locum Shortfall Payment Template to your Type 2 case.

- Go to GP Pensions enquiries | PCSE and choose Existing GP Pensions enquiry.

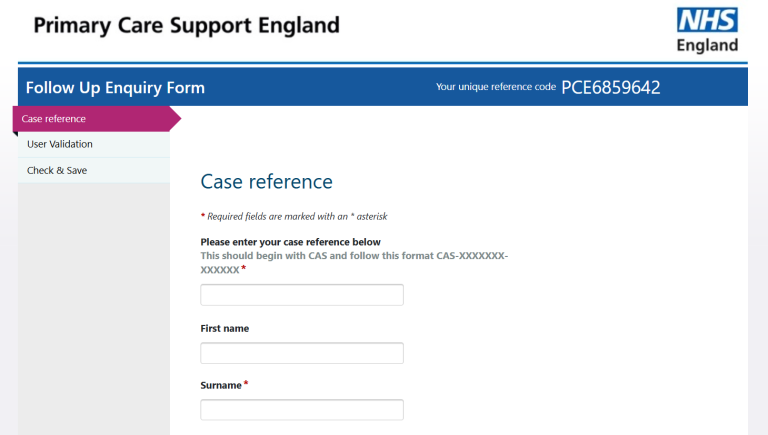

- The Follow Up Enquiry form will open.

- Click Begin

- Enter your CAS-reference number, for example CAS-1234567-1B2V3R5R and complete the required fields

This will retrieve your Type 2 case.

You can now attach any additional documents and submit. These will automatically be added to your Type 2 case.

What happens after I submit the Type 2 medical practitioner self assessment of tiered contributions?

PCSE will use this information to reconcile payments received and arrange to correct any under or over payments from the previous financial year.

Why do I need to complete the Type 2 medical practitioner self assessment of tiered contributions?

A Type 2 Self assessment ensures:

- the correct tiered contributions have been applied to your salaried GP earnings

- the amount you are due to pay for your tiered rate and any added years/additional pension contributions has been identified and shortfalls or refunds can then be dealt with by you and your employers

- that PCSE have the correct information about your total pensionable earnings so they can ensure the correct amount is paid over by your employers to them

It is a condition of a GP’s NHS Pension Scheme membership that practitioners proactively liaise with relevant NHS organisations to ensure they have paid the correct tiered contributions ‘across the board’. Failure to comply with the NHS Pension Scheme Regulations may result in pensionable pay provisionally set to zero for the relevant period.

It is a legal requirement for practitioners to complete and submit the self-assessment each year.

Who completes the Type 2 medical practitioner self assessment of tiered contributions?

A Type 2 medical practitioner completes the Type 2 Self Assessment form and is:

- A salaried GP formally employed by a GP practice, Alternative Provider Medical Services (AMPS) contractor or by a Local Health Board

- A long-term fee based/self-employed GP who works for a GP practice, APMS contractor, Local Health Board for a period of, generally, six months or more

- A GP who works solely on an employed or self-employed basis for an Out of Hours Provider that is not an NHS Trust/Foundation Trust

- A practice based salaried GP who works for a ICB under a contract for services (i.e. on a self-employed basis). The ICB earnings/contributions must be declared on the self-assessment form

- A GP who is formally employed by a ICB under a contract of service (i.e. contract of employment) is an Officer and their contributions and salary are not declared on the self-assessment form

If you have been on maternity leave for any time during the period for which the form relates, you will also need to complete and submit the maternity breakdown form. Find out more here.,

What is the purpose of the Type 2 medical practitioner self assessment of tiered contributions?

PCSE will use the information provided on the self-assessment to determine whether the practitioner has paid the correct tiered contributions across all of their GP pensionable posts. The forms and guidance notes are available to download on the NHS Pensions website.

Which certificate should I complete?

GPs who only perform solo work should complete a Type 2 certificate. See the Salaried GPs & Assistant GPs for guidance on completing a Type 2 certificate.

How do I calculate my total pay for a Type 2 form, is it gross pay, pensionable pay or taxable pay?

A salaried GP’s pensionable income is their Practice salary (including overtime), plus any ad hoc income net of expenses.

Which figures go into the Type 2 end of year forms?

If you are unsure, you will need to speak with an accountant or financial adviser.

My employers do not know what their correct ODS code is.

You will find the ODS code for the organisation you worked for in the Employee Contribution Statement screen on PCSE Online.

You need to select the correct financial year and click on the 'select practices' dropdown.

How can I get my NHS Pensions (NHSP) scheme number for pensions?

Find out more here.

I'm a salaried GP but my pension contributions are being taken as a partner. PCSE Online has registered me as a Type 1 practitioner as Partner. I can't submit a Type 2 form.

If your income type is showing as profit share when you were a salaried GP, please make sure you submitted a Performer employment change from partner to salaried GP on PCSE Online and that it is showing as approved. If it is Pending, speak to the Practice Manager to get this approved.

If your employment status as partner is approved, speak to the Practice Manager as they will need to update your income type. This is done by them completing the Pensions “Leaver” form on PCSE Online to end your partner role and then completing a Pensions Joiner form to commence your role as a salaried GP. This will automatically update your Employee Contribution Statement on PCSE Online. After these steps have been completed you will be able to submit your end of year form for 2022/23.

If you have never been a partner at the practice, please use the “Pensions Contribution Query” option on the Contact Us form and provide the details of how what you are expecting to see on your statement differs from what PCSE Online is showing so that we can investigate for you.

Do Partners complete Type 1 and Type 2?

Partners need to complete a Type 1 form.

If you have been a Partner and a salaried GP in the same year you will need to complete a Type 1 and Type 2 form for that year.

I was abroad for a year in the past and I didn’t pay any pension then. Will my years before I went not be updated?

You only need to submit forms for years where you undertook work in a primary care setting as a Principal or Salaried GP.

What support is available for GPs to complete the Type 2 forms?

You can find lots of of guidance on both the NHS Pensions website and the PCSE website Type 2 Self Assessment webpage.

Can the Type 2 form be submitted by another person on my behalf, eg Practice manager?

Your Type 2 form can be completed by a third party e.g. Accountant or Practice Manager but you need to sign and date the declaration page before the form is submitted.

I am unable to upload my form, is there anything I should be aware of?

Please note, this FAQ relates only to the 2023/24 Type 2 paper form. You can now complete and submit 2023/24 Type 2 forms on PCSE Online.

2023/24 Type 1 Annual Certificates still need to be downloaded from the NHS Pensions website.

Our system only supports the following file types:. .jpeg, .jpg, .gif, .tif, .bmp, .img, .png, .svg, .doc, .docb, .docm, .docx, .dot, .dotx, .pdf, .txt, .csv, .xls, .xlsx, .rtf, .ods and .odt

File name must not include any special characters: !ӣ$%^&*()@.

The maximum file size you can upload is 4MB

What is pensionable pay and how do we calculate this?

Pensionable Pay is the total gross pay on your month 12 payslip for a salaried post if you have worked the full year, or the total gross pay on your last payslip if you left the post during the year.. For Solo work, you will find your pensionable pay on your Annual Solo form. Pensionable pay for Locum work is 90% of your locum income.

Is a handwritten/wet signature required?

If you supply your nhs.net, nhs.uk or doctors.org.uk when you submit your Type 2 form a wet signature is not required

I have recently become a Salaried GP after being a GP trainee, when do I need to submit a Type 2 form?

You need to complete a Type 2 form for the pension year you became a salaried GP. For example, if you were a Registrar from January 2023 until June 2024 and started a role as a salaried or Solo GP in July 2024, you need to complete a 2024/25 Type 2 form declaring the salaried role only, and complete the annualisation calculator to determine the correct tier rate as you were only classed as a practitioner for part of the pension year.